By D.K. Matai

A Growing Confrontation?

China appears to be escalating its growing confrontation with the U.S. over Washington’s announcement of a $6.4 billion defense deal with Taiwan. Under a 1979 Act of the U.S. Congress, Washington is legally obliged to help Taiwan defend itself. The Chinese defense ministry has said that the recent deal will definitely and seriously disturb relations between the two countries.

So far, in retaliation for this specific decision, China has:

- Imposed sanctions on U.S. companies involved in the deal with Taiwan;

- Suspended military exchanges because of the allegedly harmful effects of the deal on U.S.-China relations; and

- Stated, “It will be unavoidable that co-operation between China and U.S. over important international and regional issues will also be affected.”

This new row is not a one-time event, but rather a manifestation of an increasingly fraught relationship between Beijing and Washington, marked by a growing tone of irritation and even confrontation in public comments by Chinese leaders and officials. Moreover, this heightened irritation appears to be spreading to China’s relations with a number of other governments, in particular India and some important European nations.

Diplomats in a number of countries are commenting that statements and routine meetings with Chinese officials are characterized by increasing belligerence, suggesting an historic shift in China’s stance towards other nations. While there are a number of plausible explanations for this emerging belligerence, most disturbingly it represents a calculated necessity to escalate a cold conflict with key nations around the world in an effort to shift blame away from rising domestic economic woes on an unprecedented scale.

A Classic Strategy of Diversion?

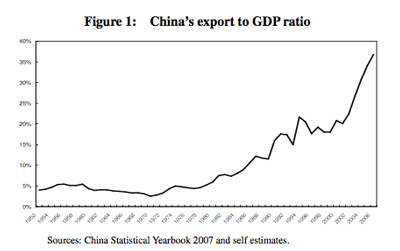

The principal weakness of the Chinese economy is it’s over reliance on exports to propel domestic economic growth ( see graphic from the Hong Kong Monetary Authority). During the current recession, world demand for Chinese exports collapsed, leaving China with industrial over capacity. According to some calculations, China must cut industrial capacity in double-digit percentages to align its economy with the slower pace of world economic activity. Instead, the Chinese leadership has not only chosen to retain industrial capacity at 2007 levels but has continued adding to the established production capacity and industrial infrastructure in the last few years.

Domestic capital spending is now estimated to account for more than half of the annual rate of GDP growth. The more industrial capacity China adds and the more it builds, the more GDP figures will rise. However, many of those buildings, warehouses, and industrial plants are lying completely unoccupied or moth balled at present. Evidence suggests that within some urban centers as much as 70% of the new buildings and industrial units are completely empty. Even if world demand were to regain upward momentum, China already has production capacity far in excess of any conceivable growth in world demand for the next several years.

Unlike the economies of the U.S. and India, China has weak domestic demand. Recent statements by Chinese officials at the World Economic Forum in Davos acknowledge the need to shift attention to the need for increased domestic consumption. However, it is not possible to change the structure of the economy overnight to divert the entirety of excess industrial output to domestic consumption.

In addition, considering the lifestyle and living standards gap between Asian and Western countries, many of the products manufactured in China cannot be absorbed by the domestic economy or exported to other Asian powers like India.

China’s continued double-digit GDP growth has been maintained via an unprecedented stimulus package that represented nearly half of the country’s GDP in 2009. This amount was much larger than any stimulus package presented by the G20 countries. Clearly, this type of government intervention cannot continue without severe fallout. The impact on asset price inflation and core domestic inflation has been far from benign in the second half of 2009 with double digit percentage advances in specific economic sectors and regions of China.

As China begins applying brakes in 2010 to address its runaway train phenomena, it risks causing sharply rising unemployment while depressing its domestic property and financial markets, trapping millions of citizens and thousands of industrial groups in negative equity.

Chinese leaders may find it politically attractive to divert the attention of their citizens away from an unbalanced national economy – unwinding swiftly in 2010 and beyond – to growing pressures on China from other nations. This tactic will lay blame for the domestic mess on foreign powers and entities that are alleged to seek to interfere in domestic matters, a story that has played out many times in Chinese history.

Top Ten Concerns

Recently, the U.S. has demanded that China undertake a serious and transparent investigation into all cyberattacks on U.S. commercial and government targets. The Chinese reception to such ideas has been extremely cold and even confrontational. As a result, the U.S. has made its views on free internet access more voluble and frequent, causing further irritation in Beijing.

It is now becoming clear that China’s “cold war” with the U.S. and other powers is becoming manifest beyond the increasingly interactive segments of economic and diplomatic relations, suggesting rising tensions and potential for intractability sooner rather than later.

Among the top ten concerns are:

- China-Taiwan strategic balance;

- Cyber attacks, not only on Google but on at least 30 other U.S. companies, as well as ongoing attacks on the U.S. government and military establishment;

- Parallel cyber attacks on the Indian Prime Minister’s offices and other parts of the Indian security establishment, and apparent statements of concern on the part of the German and French governments in regard to cyber vulnerability;

- Internet censorship, suppression of freedom and activism, and human rights violations;

- Severe standoff at the Copenhagen Summit with regard to climate change negotiations;

- Tit-for-tat trade sanctions and public confrontation over demands made by the U.S. President and other foreign leaders that China alter its currency policy;

- Differences in approach to dealing with Iran via UN mechanisms;

- North Korea’s nuclear proliferation;

- Military presence in Pakistan; and

- Ongoing border disputes with India, which are taking an increasingly provocative character.

Given the complexity and concatenation of these top ten evolving concerns across multiple dimensions, there is growing risk that the “cold war” may escalate further with unanticipated consequences for financial markets, world trade, global businesses, policies of governments, and their national security agenda.

———-

***Posted March 7th, 2010