The Greek Economic Crisis And Defense Budget Cuts: A Question of Balance

By Harry Syringas

**@*****fo.com

Greece’s economic crisis and recent bailout have called for budget cuts across the board, including in its defense budget. Hence, given the fact that major arm suppliers of Greece, like Germany, demand reduction in the public sector – that includes also defence – one couldn’t resume best the situation as a: “…a conundrum. We call them offset agreements, but they are offside agreements. They really undermine the whole process, if you give with one hand and take with the other in this kind of crisis“.[1]

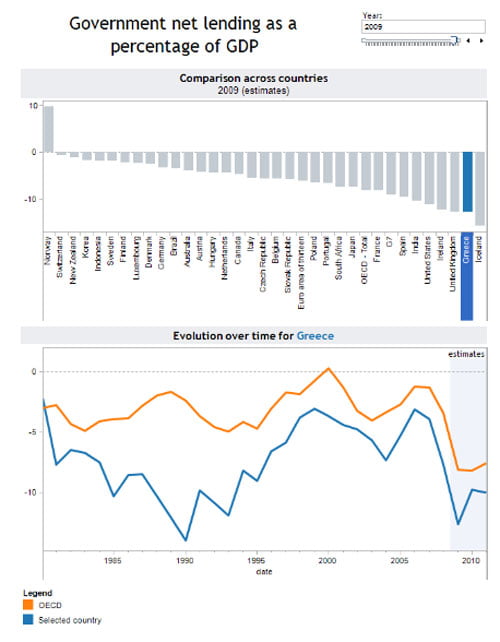

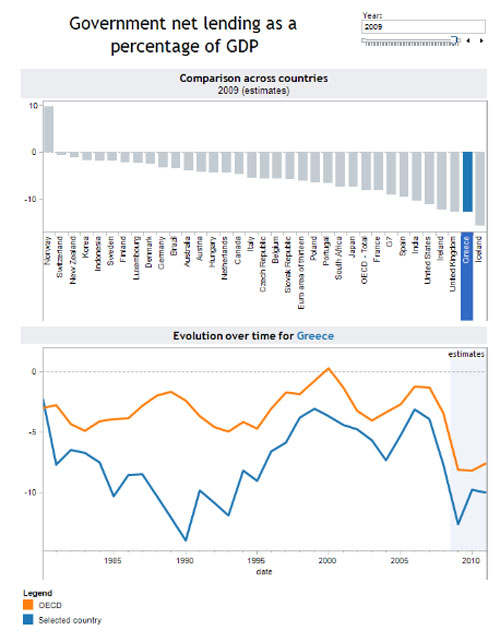

Credit: Government Net Lending as a Percentage of GDP (Greece in blue), OECD , March 23rd, 2010

Credit: Government Net Lending as a Percentage of GDP (Greece in blue), OECD , March 23rd, 2010

The Greek Paradox: The Reason for Spending More Than It Can Pay for Defense

Greece has always spent more on defense than it could afford. Despite the debt the country is bearing, it is currently meeting NATO’s set spending target of 2% of GDP. Relative to its surface, population, and normative role in the international scene, Greece has been one of the biggest spenders in the alliance for decades. The country was already on the way to recession in 2009 when it raised its defense budget by 6.9% – from €5.81 billion to €6.24 billion. Indeed, according to the Stockholm International Peace Research Institute (SIPRI), Greece was the world’s fifth-biggest weapons importer from 2005 to 2009.

Greece’s geopolitics, despite its size and population, has always played a crucial role in its behavior as an actor in international relations. A peninsula stuck between the West and the East, the country has suffered a series of wars throughout history. Even now, geopolitics contribute to its defense spending, as a long-lasting rivalry with its eastern neighbor and NATO ally Turkey is still the main reason Greece never really cut or scrutinized its defense budget. After centuries of hostilities, a four hundred year Turkish occupation of the Greek mainland and islands, two Balkan wars, numerous crises in the 20th century, the creation of the “grey zones” (set of interrelated controversial issues between Greece and Turkey over sovereignty and related rights in the area of the Aegean Sea), and the dispute over Cyprus, the two countries have lately tried to bridge the differences through economic diplomacy and investments instead of dealing with their armies. Even when the Greek government officially cut its defense spending, Turkey never did the same despite the will of progressive and pro-European Prime Minister Erdogan, who opts for less army power and more political stability.

The Financial Crisis and Its Consequences: A 25% Cut In Operating Costs As A Starter

What happens though when a country faces its worst financial crisis in the past few years and asks other Euro Zone states and the International Monetary Fund for loans? Severe cuts took place this year in public sector wages and pensions as well as changes in the pension, health, and civil service systems. These changes were mandatory according to the terms of the loan to tackle fiscal problems. The defense budget, which up to now has been hardly scrutinized, cannot be an exception. Defense Minister Evangelos Venizelos announced that the government planned to cut back on operating costs by up to 25% in 2010 from 2009, instead of the planned reduction of 12.6% listed in the 2010 budget. Greece was asked to tame its 13.6% budget deficit to the allowed 3% ceiling by 2014, according to the 2014 EU’s Stability And Growth Pact directive. [2]

That date was set by the EU and IMF as part of its bailout agreement. With the Greek economy expected to contract by up to 4 percent this year and again in 2011, the reality is that meeting that investment level is a near impossibility, according to Forecast International’s European Defense Analyst Dan Darling.

Even so, this figure represents the highest annual share in real terms among all of Europe’s NATO member states. It is interesting, not to mention impressive, that the two highest nominal defense spenders in Europe – the UK and France – give out 2.3% and 2%, respectively, to their militaries annually and like Greece, they have their share in budget deficit and national debt problems and consider their defense a possible source for budget cuts.

However, cutting back on military expenses does not mean capitulating on the country’s army modernization program. As a member of NATO, Greece is expected to spend in order to preserve global security, according to the Alliance’s goals. To achieve that, the Greek government negotiates with some of the countries which ask for it to tide up its finance so that the rest does not get in trouble as well. As a result Greece bought four type-214 submarines from Germany and six Fremm frigates from France, worth €2.5 billion ($3.38 billion).

As the economic crisis settles in in Europe, one may wonder about this growing gap between EU’s and NATO’s requirements towards its overlapping members….

———-

Footnotes

[1] Spyros Economides, senior lecturer on international relations at the London School of Economics: presentation on the Greek financial crisis.

[2] That date was set by the EU and IMF as part of its bailout agreement. With the Greek economy is expected to contract by up to 4 percent this year and again in 2011, the reality is that meeting that investment level is a near impossibility, according to Forecast International’s European Defence Analyst Dan Darling.

See: Wyrzykowska, Monika, Greek Military Spending in Light of the Euro Zone Crisis, 8 June 2010, http://atlantic-council.ca/?p=1662)

[3] See the draft of “Strategic Concept”, a 10-year vision for the Alliance designed to help define the challenges it will meet in the 21st century.

Additional Reference

- Greek Military Spending Under The Spotlight After Economic Crisis, NATO Parliamentary Assembly, May 29th, 2010

———-

***Posted on September 7th, 2010