06/07/2011 By Dr. Harald Malmgren

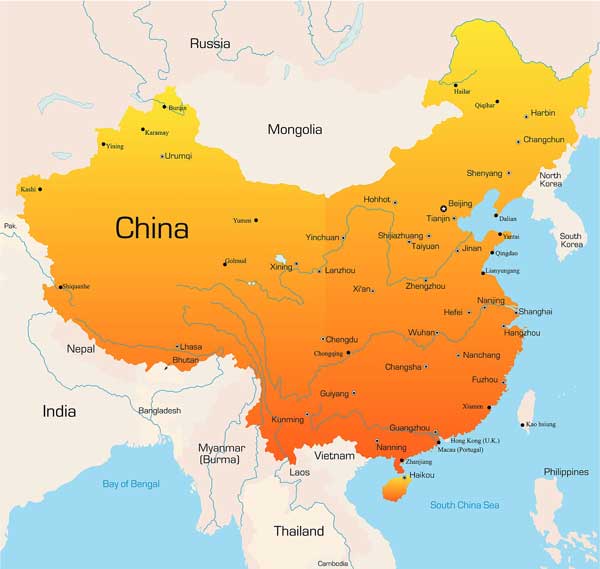

Sunrise or Sunset of Chinese Rise? (Credit: Bigstock)

Sunrise or Sunset of Chinese Rise? (Credit: Bigstock)

06/01/2011 – The China we have known in the last 15 years will not likely be the China of the next 15 years. The extent to which China can project power in the next 15 years depends upon China’s internal economic and political dynamics, China’s interaction with its Asian neighbors, and most importantly on the evolution of China’s relationship to the US.

As a result of China’s one child policy, its work force stopped growing in 2010 and began contracting in 2011. From now on China’s labor will contract at a rate of about 0.33 percent per year. Even if multiple births were allowed per family, it would take more than 15 years for increased births to become manifest in the work force. This also means continuing reduction in the number of young men who could serve in China’s military. The shrinking labor force will have to support a growing older population, putting a demographic restraint on the economic growth rate in the next 15 years. Wages are already escalating in China, pushed by rising costs of food and fuel. For the Chinese government to succeed in shifting from an export engine to a domestic consumption engine to pull growth, the wealth of China would have to be spread to an ever-widening workforce. This means wages will have to escalate even faster.

Foreign manufacturers operating in China are increasingly facing three challenges: Chinese labor costs are undermining Chinese competitiveness; Chinese quality control is poor; and bringing advanced technology products and production processes to China ends up with theft of that technology. Japanese companies that have been making things in China for decades no longer see China as a supply chain hub.

Now, they see making things for Chinese consumption as desirable, but using China as a source for components and subassemblies for export to the rest of the world is no longer competitive and likely to end up with problems of product recalls. American companies are coming around to the same view.

In other words, the dream of China as the manufacturing hub of the global economy is over.

China’s high rate of growth was long dependent on a high rate of exports during decades of high rates of growth of world trade. Since the summer of 2008 the world went through the deepest, longest contraction of world trade since the Great Depression. Even now, in 2011, world trade is not growing fast, and has only just reached back to the peak of 2008. Given that China is also less competitive globally, the export engine cannot be sufficient to keep China growing at double digit rates. Shifting to a growth engine based on domestic consumption or consumption in the nearby neighborhood will take several years.

To offset the collapse of trade since the summer of 2008, the Chinese government implemented extraordinary fiscal stimulus (bigger than that of the US) and ordered all banks to open credit to whoever walked through the door. Artificial lending reached levels which exceeded US financial bank bailouts and quantitative easing by the US Federal Reserve (quantitative easing), with the result that the entire banking system of China could be said to be nearly insolvent, sitting on vast non-performing loans mandated by Communist leadership.

Chinese industry is already flooded with excessive inventories of raw materials and finished products for which there is inadequate global demand.

With economic growth likely to slow, and rising social unrest driven by inflation and economic slowdown, and diminishing manpower, China will have limited options for projecting power. China’s army is local, not national. With social unrest likely to grow, a process of decentralization and fragmentation is not inconceivable, with the result of emergence of a kind of federation, with armies rather than a single army.

China can pressure neighboring countries over issues of jurisdiction over waterways, islands, offshore drilling rights, etc. and try to “Finlandize” the neighborhood, leaving few allies for American operations, bases and support.

China can focus military spending on means of degrading US capability in the region (satellite busting, EMP communication disruption, cyberwarfare, etc.).

China can give priority to any means of forcing US capabilities to move further away from China’s zone of influence (including parading of carrier busters, increased submarine capability, and aggressive close contact testing), with the possibility of aiming for a Chinese Asian-oriented equivalent of the Monroe Doctrine.

But China is unlikely to be able to confront US military power head on in the next 15 years. Chinese economic leverage on the US will not be powerful. China does not have alternatives to holding US Treasuries, and selling Treasuries would automatically lower the value of Chinese reserves as well as pushing up the value of the Chinese currency much faster (selling Treasuries and dumping the dollars have the effect of pushing up the renminbi).

China’s power projection therefore depends upon U.S. responses to Asian growth:

- Will the US develop new economic and security alliances (India, Asean countries, etc.) and enhance ties to Japan?

- Will the US develop a strategic counterweight with increasing interaction with India and its navy and airforce?

- Can the US Defense Department bring itself into a new framework of thinking involving joint development of next generation weaponry and logistical support with Asians, integrating the future of their security and economic growth with that of US interests?

There is no preordained outcome of China emerging as the dominant superpower in Asia. China’s starting point is too fragile.

The key question is whether the US abandons interest and involvement with Asia, or instead has a policy of engagement and encouragement of a growing web of mutual interests across the Pacific in which China can prosper without ability to seek, much less achieve, domination.