By Richard A. McCormack

ri*****@***************ws.com

Originally published in Manufacturing News , Volume 17, No.5 on March 31, 2010

It might not be very long before Silicon Valley, Calif., starts to take on the characteristics of Shenango Valley, Penn., if state and national policies don’t change to encourage investment in manufacturing and high-tech production, says Hank Nothhaft, president, CEO and chairman of the board of Tessera Technologies Inc. of San Jose, Calif. Nothhaft was raised in Sharon, Pa., which is on the border of Ohio in the far western part of the state in the Shenango River Valley. Growing similarities between Silicon Valley and Sharon, Pa., have Nothhaft worried.

California is hemorrhaging manufacturing jobs, similar to what has been occurring in the industrial Midwest. “Could Silicon Valley have aspects of Sharon if policy changes aren’t made?” Nothhaft asks. “Yes. The canary in the coal mine is high-tech manufacturing.”

Silicon Valley has a lot going for it, and with changes in tax policies, incentives and the business climate, the region can stage a strong recovery and avoid long-term economic decline. It has resources not available in a place like Sharon, such as a large and vibrant university system that includes Stanford and Berkeley, a globally oriented high-tech labor force, entrepreneurs, venture capitalists, lawyers and accountants skilled at invention and starting new companies.

But none of these strengths guarantee success. And places like Sharon, Pa. didn’t go into decline overnight either, says Nothhaft. “Sharon was an industrial center for 200 years,” he says.

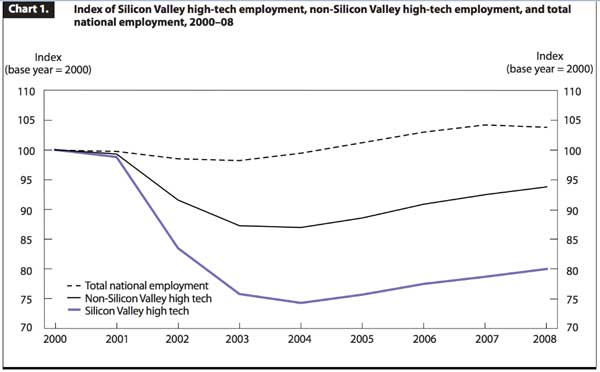

Silicon Valley is exhibiting similar signs of decline, though they are not as apparent.

Nothhaft’s company occupies a building in San Jose in a parkland setting with redwood trees. “But a very significant portion of the buildings in my immediate area are absolutely empty,” Nothhaft notes. “Whoever owns the buildings is keeping all of the landscaping up, so they are beautifully maintained, but they are empty and have been for years.”

According to press reports, Silicon Valley has 44-million-square-feet of vacant office and research space — an amount equal to 15 Empire State buildings. In places like Sharon, Pa., an empty building is an eyesore. In Silicon Valley, the only way to know that a spruced-up building is empty is that there aren’t any cars in the parking lot.

“If we don’t change our policies right now and get our statehouse in order and change some of the national policies, then we go into steady decline,” says Nothhaft. “We are close to the tipping point.”

Besides empty buildings, there are other parallels between Silicon Valley and Shenango Valley. The middle class in Sharon — along with a tradition of upward mobility — has disappeared with the manufacturing base. “I see very strong signs of that out here,” says Nothhaft. In Sharon, it was possible to graduate from high school, find a good-paying factory job, receive training, and work your way up into a management position in companies making specialized steel or transformers at the local Westinghouse plant. Children could go to college, return to Sharon and pursue a fruitful career with a technically strong industrial company.

Not any more.” Even coming out of college and trying to land an entry-level job [in Silicon Valley] is very tough,” says Nothhaft. There are even fewer good middle-class career opportunities for those without a college degree. According to the Bureau of Labor Statistics, California lost 600,000 manufacturing jobs from January 2000 to January 2010, from 1.84 million to 1.24 million, a 33 percent decline, and the trend remains downward especially with the exodus of the aerospace and defense industries.

California is now ranked as being the 48th worst state in the country to do business, behind New Jersey and New York, Nothhaft notes. Individual and corporate taxes are high, along with “sneaky” taxes, such as 10 percent surcharges on capital equipment. The cost structure is also high. State finances are out of control. Manufacturing is moving to Oregon, Washington, Nevada, Arizona and Texas. Highly educated first-generation immigrants, who constitute almost 50 percent of the CEOs and CTOs of new companies, are going back to their home countries. “It is now more favorable to do a startup in Communist China than it is in the heart of Silicon Valley and the greatest capital economy in the world,” says Nothhaft, a graduate of the U.S. Naval Academy and former officer in the Marine Corps.

California is now ranked as being the 48th worst state in the country to do business, behind New Jersey and New York, Nothhaft notes. Individual and corporate taxes are high, along with “sneaky” taxes, such as 10 percent surcharges on capital equipment. The cost structure is also high. State finances are out of control. Manufacturing is moving to Oregon, Washington, Nevada, Arizona and Texas. Highly educated first-generation immigrants, who constitute almost 50 percent of the CEOs and CTOs of new companies, are going back to their home countries. “It is now more favorable to do a startup in Communist China than it is in the heart of Silicon Valley and the greatest capital economy in the world,” says Nothhaft, a graduate of the U.S. Naval Academy and former officer in the Marine Corps.

There are immigrants at Tessera Technologies with Ph.D.s from American universities who have been in the United States for 20 years and are being lured back to China with subsidies and land grants from the Chinese government to start high-tech firms. These entrepreneurs “are retaining very high percentages of ownership and they become quite wealthy and have access to low-cost engineering talent,” says Nothhaft.

The reverse brain drain is being abetted by U.S. federal policies that make it hard for foreign students receiving advanced technical degrees to get permanent visas, even though they have skills that are in demand in Silicon Valley.

“My frustration is that very straightforward policies can solve this problem,” says Nothhaft. “They won’t avert all of it, but it would go a long way to alleviating it.”

Nothhaft is writing a book to highlight the problems and solutions. “I am hoping I can convince one person who can have an impact on this problem,” he says. “It has to be positive incentives, just like our adjacent states are offering: a predictable business environment; a predictable, rational tax system; financial incentives; tax incentives; and facilities to attract business. That will work. It is very straightforward.”

But when he hears national policymakers talk about the economy and jobs, he gets discouraged by their focus on the supply side of the equation—either increasing spending or cutting taxes. “Building another consumer product in China and Taiwan is not going to produce a high-quality job here in the United States,” says the Tessera CEO. “I have never heard anybody in Washington in a policymaking position mention the word manufacturing.”

Manufacturing remains essential to the health of Silicon Valley because once a product is invented and goes into production the subsequent innovation occurs on the factory floor. “You can say that we invent things here, that we do the thinking and other people do the sweat, but it doesn’t work that way,” says Nothhaft. “That is a superficial understanding of what is involved in high-volume manufacturing.”

Nothhaft’s company focuses on invention of advanced miniaturization technologies used in the production of semiconductors, electronics and optics. When its systems are installed in a high-volume manufacturing operation, the company signs a partnership agreement that allows its employees to work in the licensee’s factory or semiconductor lab. “We want to have our engineers in there working with the customer sharing the intellectual property so that we don’t become divorced from the progress that is going to be made in the factory,” says Nothhaft. “Unfortunately, right now, most of our new licensees are in China.”

———-

***Posted on August 17th, 2010