By Richard A. McCormack

This article was originally published in Manufacturing News on June 30, 2010.

Small- and medium-sized American manufacturing companies are feeling better about their prospects, as compared to last year at this time, but they remain cautious about the future. They are also worried about U.S. government policies that are increasing the costs of doing business in the United States, according to the fifth annual survey of manufacturers and wholesale distributors conducted by McGladrey.

From the 2010 Survey, page 14 (Credit: McGladrey’s study, June 7, 2010: http://mcgladrey.com/News-Releases/McGladreys-5th-Annual-US-Manufacturing-and-Wholesale-Distribution-Survey-Shows-Small-to-Midsized-Companies-More-Cautious-about-Economic-Recovery-than-Larger-Companies?itemid=203&mid=203)

“The recession really hit manufacturers extremely hard,” says Tom Murphy, executive vice president of manufacturing and wholesale distribution at RSM McGladrey. “When companies reduced their workforces by 40 or 50 percent and cut capacity by 30 percent, they survived — barely— and have stabilized, but their eye to the future is still very cloudy.”

Manufacturers that have invested in innovation and exports have fared better than those that have not, according to the survey. And some industries are doing a lot better than last year — such as food and beverage, medical equipment and chemicals, petroleum and plastics. But other sectors remain troubled, especially those associated with housing: building materials, fabricated metals, furniture, and paper products.

“Credit is an issue,” says Murphy. “The banks are not convinced that for particular products demand or cash flow are going to be there based on a company’s plans.” Nineteen percent of the 1,061 companies McGladrey surveyed say they are having problems with credit, with 29 percent of the smallest companies running into credit problems. Mid-sized companies of between $100 million and $200 million in revenue were concerned about credit availability impacting growth in the future. “When you have mid-sized companies saying credit is going to be problematic, that is a problem,” says Murphy.

Manufacturers are also skeptical about government policies that are working against their interests. Additional burdens placed on them by the health care bill, the potential for cap and trade, increased regulations and higher taxes to pay off mounting federal debt are proving worrisome to U.S. manufacturers. “Manufacturers are concerned that nobody [in Washington] is listening to them,” says Murphy. “If a policy does not make us more competitive globally, then why are we even talking about it?”

Taxes are eating at profits that would otherwise be invested in the business. “The concern is that many business owners are going to throw in the towel and say enough is enough, I can take this business and move the headquarters someplace else,” says Murphy. “If you want to continue going down the path we’re going down now, we might as well tell manufacturers to move [offshore] and get it over with.”

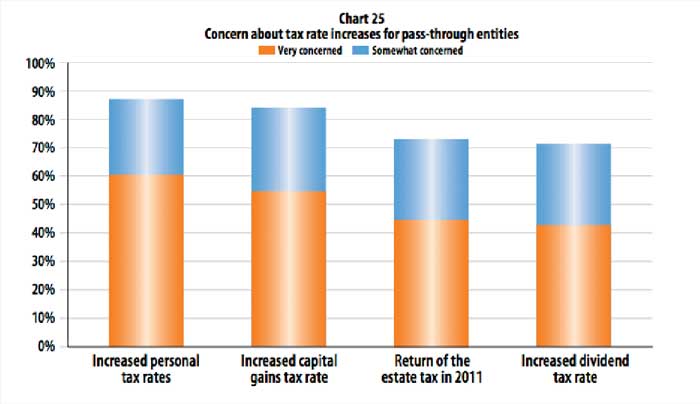

Ninety percent of companies are either very or somewhat concerned about increased personal tax rates. Murphy’s clients are asking him “all the time” about whether it would be worth moving their operations offshore in order to remain profitable.

“It’s not to the Bahamas or the other tax havens,” says Murphy. “They are saying that they may as well move their business to a place like Poland and export to the United States, because the U.S. is the market with the easiest access.”

Nevertheless, manufacturers and wholesale distributors are feeling more bullish, with 83 percent of them saying they are optimistic about their own company’s prospects, but only 52 percent saying they are positive about the direction of the U.S. economy.

From the Survey, page 26 (Credit: McGladrey’s study, June 7, 2010: http://mcgladrey.com/News-Releases/McGladreys-5th-Annual-US-Manufacturing-and-Wholesale-Distribution-Survey-Shows-Small-to-Midsized-Companies-More-Cautious-about-Economic-Recovery-than-Larger-Companies?itemid=203&mid=203)

Seventy-one percent of the businesses expect their U.S. sales to increase this year, (nearly three times the percentage forecast last year), while 44 percent said they expect their international sales to increase (up from 21 percent in 2009).

Sixty-eight percent of the companies in the McGladrey survey are importing materials for their supply chain (up from 66 percent in 2009). “Fully 25 percent of respondents import one-third or more of their supply chain materials,” says the survey. “The most active importers plan to ramp-up buying from overseas suppliers.” Eighty percent of textile companies import at least one-third of their materials and supplies.

Companies are also questioning strategies associated with moving production to China. “Today, faced with increased labor costs, fluctuating currency rates and long ship times, many companies are rethinking that assumption,” according to the survey. Adds Murphy: “Companies did their initial cost analysis and found it saved them a lot by moving to China. But three years later when they added everything up, it didn’t save as much as they thought. China is not going away, so we have to learn how to compete with them.”

Off shoring declined for a second year. In 2010 only 15 percent of business leaders said they will move some or all of their production offshore with medical (40 percent), textiles and apparel (32 percent) and electronics (26 percent) being the industries most willing to take that step. “Midsized companies express the most interest in off shoring production, led by 23 percent of businesses in the $250-million to $500-million revenue bracket,” according to the survey.

The 2009 manufacturing survey can be found here.

———-

***Posted on August 17th, 2010