By Pierre Tran

Paris – Sales and orders of the defense sector of the French aeronautics and space industry fell in 2023 compared to the previous year, while overall sales rose nine percent to €70.2 billion ($75 billion), the chair of the GIFAS trade association told a news conference April 23.

The defense market showed “a small decline,” with 2023 sales of €17.9 billion and a 25.5 percent drop in “export deliveries,” Guillaume Faury said.

Those falls followed orders for military aeronautics which made 2022 a “year of reference,” and he said “false conclusions” should not be drawn on 2023.

The United Arab Emirates ordered in 2022 80 Rafale fighter jets from Dassault Aviation, a deal worth €14 billion. Abu Dhabi also ordered MBDA missiles worth €2 billion.

Dassault delivered in 2023 13 Rafales and received orders for 60 units, which made last year a “very positive year for the Rafale,” Faury said. MBDA “signed numerous contracts,” while Thales signed contracts tied to the Rafale, Aster missile for France, Ground Master 400 radar for Indonesia, and flight simulation for the UAE, he added.

Faury is also chief executive of Airbus, a builder of airliners, based in Toulouse, southern France.

The 2023 military sales of €17.9 billion marked a seven percent fall from the previous year, while €6.9 billion of defense exports dropped 25.5 percent, the GIFAS presentation showed. Military sales to France rose 10.3 percent to €11 billion.

Sales and delivery of the Rafale weigh heavily in the military sector of the French aeronautic industry.

Dassault delivered 11 Rafales to France last year, the company said in its March 6 statement on 2023 financial results. The company also shipped two Rafales to Greece, bringing its total deliveries of the multirole fighter to 13 last year.

That output fell short of a plan to ship 15 Rafales last year, pointing up possible future difficulties in deliveries, which could make it hard to sell the fighter, International Institute for Strategic Studies, a London-based think tank, said Jan. 18 in a research note.

“The bulging order book could challenge dealmaking in the near term, with particular pressure on the Rafale industrial production set-up expected in the 2026–33 timeframe,” the IISS said.

“The French aircraft maker aimed to produce 15 Rafales last year but only completed 13. The company has not yet given 2024 production guidance, though output will likely increase this year and next, given the strong demand. Even so, it is unlikely that annual aircraft numbers will quickly reach mid-20s.”

Dassault said in its results statement that drop in Rafale deliveries was due to problems in the supply chain, which also led to a fall in shipping its Falcon business jet to 26 from a forecast 35. There was also delay in the entry into service of the Falcon 6X, the company said.

The company said in its guidance for 2024 financial results it expected to deliver 20 Rafales and 35 Falcons, with an expected rise in annual sales to some €6 billion. That compared to 2023 sales of €4.8 billion.

On prospective foreign sales, India is in negotiations for an order for 27 Rafales for its navy, and the Indian air force is keen to add a further 36 fighters, the IISS said.

Other export prospects include Serbia, which said April 9 it expected to sign a contract for 12 Rafales in the next two months, Reuters news agency reported. That fighter deal was worth some €3 billion and would replace an aging fleet of Mig 29 fighters.

A Serbian order of the Rafale would echo a procurement of a similar number of the French-built fighter by its neighbor, Croatia, with which there are tense relations.

Dassault is also in talks for a sale of the Rafale to Colombia, which had reportedly shortlisted the fighter but had run into financial difficulty before a deal could be sealed.

On the GIFAS presentation of 2023 military orders, the value of orders fell 50 percent to €20.3 billion, of which export orders dropped 67.4 percent to €9.2 billion, and French orders fell 9.2 percent to €11.1 billion.

France placed in December 2023 a long awaited order for 42 Rafales, as set out in the 2024-2030 military budget law adopted in July 2023.

Indonesia also placed in 2023 an order for a second batch of 18 Rafales. Jakarta’s order for the third and final batch of 18 units came into effect on 8 Jan. 2024, bringing the total order to 42 French-built fighters.

Total civil, military and space orders fell slightly last year to €65.1 billion, down 4.7 percent in the previous year, GIFAS said. Exports accounted for 73 percent of those orders.

Airbus accounts for the bulk of civil orders, and demand for the European aircraft has risen as its U.S. rival, Boeing, has struggled to deal with safety concerns over its 737 Max airliners.

While total French aeronautic and space sales rose nine percent to €70.2 billion, of which exports accounted for €45.7 billion, the true benchmark was the 2019 sales of €74.3 billion, before the Covid crisis hit the French aerospace industry, Faury said.

Last year was a year of “recovery” and “growth,” he said, but there was clearly still a struggle for subcontractors in the supply chain.

The French aerospace industry employs 210,000 workers, and is looking to recruit 25,000-30,000 this year. Some 30 percent of the work force are women, and the recruitment drive includes 6,000-7,000 student internships.

Urgent Need for Ukraine

In the small-medium sized companies, there is Delair, which is due to deliver this summer 100 mini-UAVs, the first batch of a French planned procurement of 2,000 loitering munition drones, also known as “kamikaze drones.”

The company will supply a modified version of its UX11 drone, which will carry a munitions package from its project partner, Nexter, the French unit of KNDS, a Franco-German builder of tanks and artillery.

The Delair chief executive, Bastien Mancini, showed March 20 its assembly room of drones to the Association des Journalistes Professionels de l’Aéronautique et de l’Espace (AJPAE), a press club. The privately held company is based in Labège, just outside Toulouse.

There was something of the look of high-tech cottage industry, with wing and fuselage parts, propellers, and command and control systems laid out around the room for careful assembly.

France will ship that initial batch of drones, ordered under an urgent operational requirement, to Ukraine. Kyiv has said it is in sore need of renewing its stock of arms, as Russian forces advance against Ukrainian troops, hampered by lack of ammunition and air defense.

The Ukrainian use of the U.S.-built Switchblade loitering munition against Russian armor grabbed attention of the public and militaries around the world, prompting the French forces to search for a similar weapon.

The remaining 1,900 munition drones will be shipped to French and Ukrainian forces, the French armed forces minister has said. How they will be divided and the value of the order are undisclosed.

The Direction Générale de l’Armement procurement office and its specialist agency Agence Innovation Defense last year selected the Delair-Nexter drone, along with a munition drone proposed by missile maker MBDA, and its project partner, Novadem.

Some 20 partnerships pitched in that drone competition, dubbed Colibri, and it has been reported those other projects could be proposed for the outstanding order for 1,900 drones.

The armed forces minister, Sébastien Lecornu, visited Feb. 29 Delair, and he said France was also renewing an order for a further 150 mini drones from the company, namely the DT26 and UX11. That deal announcement follows an order in July last year for 150 Delair drones, comprising 50 DT26 and 100 UX11, for sending to Ukraine.

Kyiv showed close interest in an anti-jamming capability in the drones.

Delair reported 2023 sales of some €10 million, and expects to double that revenue this year. The company is tripling production, building 12 drones a month, up from four a month. Delair is recruiting 40 staff this year, after hiring 30 last year. The unit cost of a drone is understood to be €4,000-€5,000, depending on the payload.

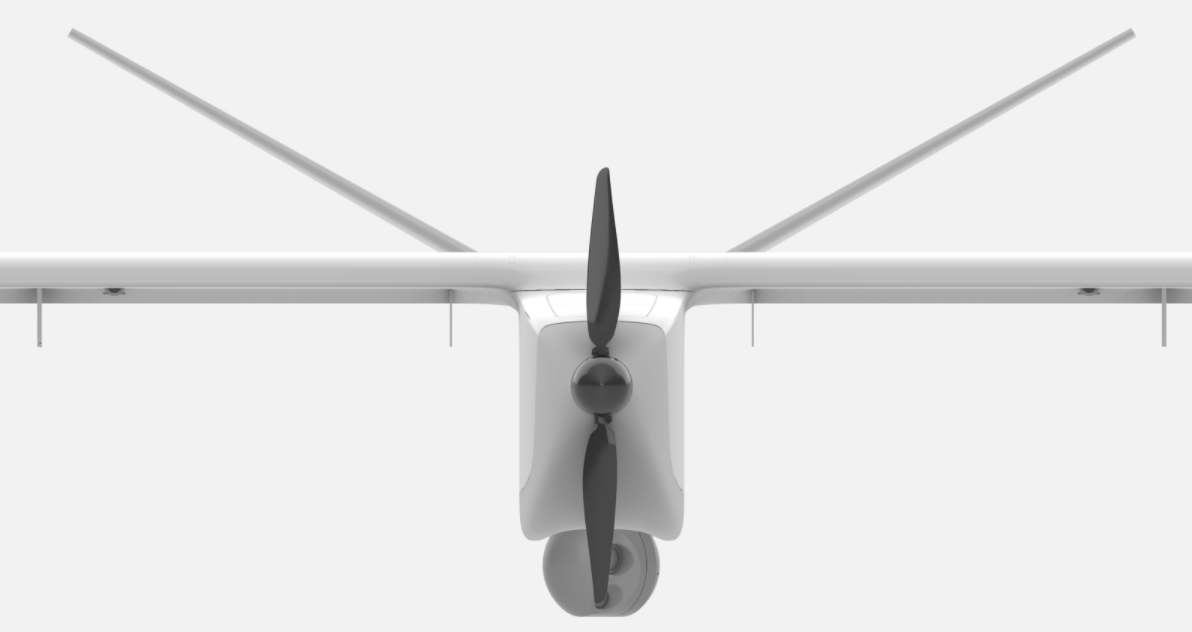

The company has tested its DT46 drone on the French navy’s Tonnerre helicopter carrier. That UAV is capable of vertical lift as well as catapult launch.

The company started building drones for the civil market, with its first UAV, the DT18, receiving certification in 2012. That aircraft was designed for inspection of pipelines and electricity lines.

Delair sold drones in 2016 for use by the Organization for Security and Coperation in Europe for surveillance of Ukraine’s border with Russia.

Lecornu told the press pack on his visit to Delair, the French-built drones being sent to Ukraine were “absolutely fundamental in the conduct of operations,” and “complementary to the Caesar cannon in the artillery domain.”

“These drones are essential for the battlefield because these are drones which will save the soldier’s life,” he said.

Featured Image: The Delair DT46 drone. Credit Delair.