By Richard McCormack

(Manufacturing News)

The Eradication of the U.S. Industrial Base Worsened by the Crisis

The U.S. military risks not being able to field an army if Congress does not start addressing the loss of the American industrial base by reforming tax laws to encourage domestic production. “The defense of our country is in perilous state,” according to Col. Michael Cole, deputy chief of staff at the Joint Enabling Command of the U.S. Joint Forces Command. “The message of the few who are aware of the problem is not reaching the key government decision makers.”

Strategies currently in place to deal with an industrial base that is increasingly unable to supply the military with manufactured parts and electronic components are not working, argues Cole.

The Diminishing Manufacturing Sources and Material Shortages (DMSMS) program does not address the bigger issues involved with the “eradication” of the U.S. industrial base. The loss of U.S. industrial capability “is no ordinary budget problem that can be solved by an infusion of money, even if there was money to spare,” according to Cole in a paper on the subject. “The unfortunate aspects of DMSMS are that no U.S. agency is responsible for managing industrial policy as it relates to national defense, and the loss of the industrial base is a self-inflicted wound created ultimately by corporate tax laws that encourage offshore manufacturing.”

The U.S. manufacturing sector has been in trouble for years, but the recession made things even worse, Cole notes. An inevitable decline in the defense budget does not bode well for DOD’s ability to support the industries that are involved in the production of weapons system.

Moreover, as program managers confront reduced budgets, they are becoming more motivated to buy cheap components made overseas. “If there was ever a crisis situation with China it is likely our shipments from China would cease,” says Cole. “A country devoid of its industrial base with plenty of soldiers left to fight can hardly wage a long-term war. Knowing that Congress is aware of the DMSMS problem and has formed a commission [the U.S.-China Economic and Security Review Commission] to study it does mean that there is hope for a solution.”

Towards the Creation of a “National Security Resources Board”?

Currently, the DOD “solution” is to issue regulations requiring program managers to use a “Shared Data Warehouse” on parts and supplies “so that other programs may benefit from the solution,” Cole notes. The second strategy is for program managers to perform so-called “resolution cost tradeoff studies when evaluating solutions for non-available parts” as contained in DMSMS Guidebook.

These programs have “proven ineffective,” says Cole. “The simple fact that the U.S. does not have an empowered agency to manage DMSMS and it is cheaper to manufacture offshore are the issues Congress must address.”

Cole recommends that DOD create a new “National Security Resources Board,” an idea promoted by Joe Muckerman, former director of DOD’s Office of Emergency Planning and Mobilization. Such a board would be responsible for assuring there is a strategy to deal with rebuilding American industry so that it is capable of producing the weapons systems that are needed.

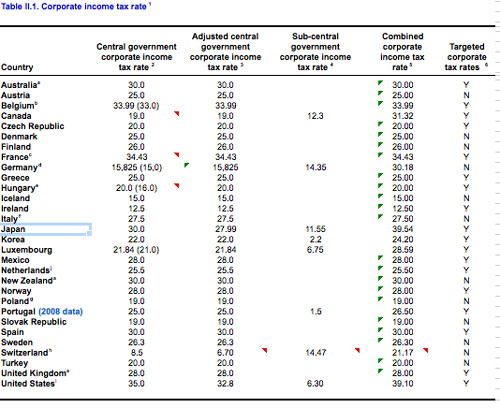

Secondly, the U.S. tax structure is working against the sustainment of an industrial base upon which the military depends. The corporate tax rate of 35 percent is “embedded in the cost of each item in each weapon system sold in the United States,” Cole notes.

Combined with the additional corporate taxes in 24 of 50 states, the U.S. corporate tax rate is the highest n the world, giving U.S. industry little reason to stick around. Furthermore, other nations collect value added taxes and rebate them on exported goods to the United States, leading to yet another disadvantage for American-based producers and another incentive for U.S. production to ship out.

Cole says there have been plenty of studies on the “fair tax,” which would require the imposition of a revenue neutral national sales tax on products at the final point of sale, while eliminating corporate and individual income taxes.

“With the abolition of cumulative corporate income taxes imposed on goods produced in the United States, American manufacturers would finally have the level playing field necessary to preserve the industrial base,” says Cole. Combined with creating a border-adjustable tax system, the United States might be in the position of rebuilding its industrial base. “The fair tax is by far the most comprehensive plan and a strategic answer to the DMSMS problem,” according to Cole. A fair tax proposal had 72 co-sponsors in the House of Representatives in 2007, and four sponsors in the Senate.

“One day, Congress will be forced to grapple with the effects of DMSMS and the eradication of the industrial base,” says Cole. “The best course of action is to act now to avoid dealing with the inability to acquire and sustain U.S. weapons systems during a national emergency. Tax reform through the fair tax and the National Security Resources Board oversight of the industrial base are DMSMS solutions whose time has come.”

***

Colonel Michael Cole can be reached via e-mail at mi*************@*****my.mil.

———-

***Posted January 31st, 2010