By Dr. Robbin Laird and Dr. Harald Malmgren

The Euro crisis associated with the May, 2010 Greek bailout is more fundamental than closing a one-time hemorrhage of debt imbalances. Politics within the Eurozone national governments are putting severe stresses on the cohesiveness of Continental Europe. Germany wants the rest of Europe to sign up to a crash diet to cut deeply into the accumulated fat of social spending and retirement excesses. Germany’s neighbors want Germany to fund the health spas which the rest of Europe believes is needed to meet German demands. People in the streets of Europe are rebelling against their own governments’ efforts to impose spending cuts and tax increases, and now they are starting to question the benefits of being aligned with a stingy Germany. For different reasons, the idea of leaving the Euro and returning to national autonomy has come back to life, not only in Greece but also in Spain, Italy, France and even Germany. The historical forces of fragmentation are once again at work.

The process of putting Humpty Dumpty together again would require nothing short from a significant advance beyond the Maastricht Agreements, which put the Euro together in the late 20th Century. That bargain, which put the new Europe together, lived in a permissive financial and political environment of the 1990s. That environment vaporized as the Great Recession gripped the world from 2007 onwards, posing huge financial and political challenges to Europe, to the trans-Atlantic relationship and to the global competition.

- The first consequence will be diminished power of Brussels over the nation states which constitute the European Union. The Germans insist on becoming a “more normal power” and want to protect their financial stability against outsourcing economic equality within Europe through the mediation of Brussels and its various funds. The more prudent “nationalistic” course in Bonn will most likely be re-enforced by a deeper relationship with London. The British have been skeptical of the Euro and the creation of a common currency without a common budgetary process from the outset. They have been proven right to do so. Now a new government has come to power, which must deal with the growing fiscal deficit of London precisely at a time when Berlin is seeking partners in a more prudent fiscal management approach for Europe as a whole.

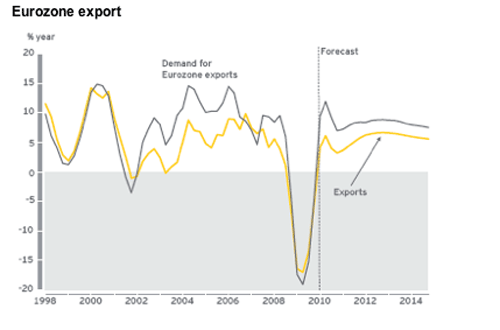

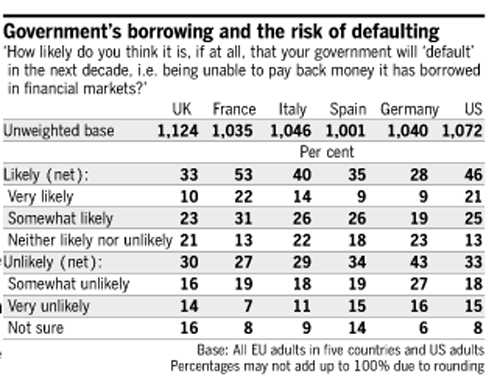

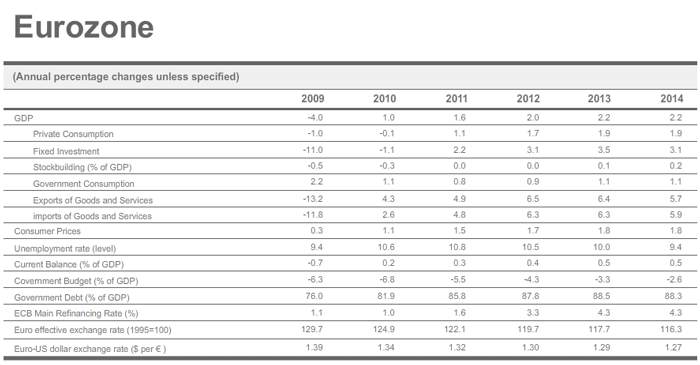

- The second consequence of the crisis is to highlight the growing tension between the costs of the social welfare system in Europe and the need for a new growth model. The current social welfare system in Europe was funded by substantial domestic growth in the 1950s and 1960s, and by export growth in subsequent decades. The sustained growth momentum of recent years has now been called into question by aging of the European population and a dramatic slowdown in world demand for what Europe wants to sell. Having grown addicted to reliance on external demand, Europe allowed domestic consumption to take a back seat to boosting exports. World trade fell into a deep, sustained decline in 2008, for the first time since the Great Depression, and even now shows little sign of recovery to pre-2008 rates of growth. As growth slowed, national governments chose to run bigger and bigger deficits to keep up social spending, increasing borrowing by selling debt not only to their own banks but to other banks throughout the land of the Euro. Debt has piled onto debt, and now the Eurozone leaders have devised a financial “shock and awe” response which adds yet more debt, in a vain effort to convince world investors that the Euro and the European Union can survive. This has left Europe with a very slow or even negative growth economy. Leaders in Europe now need to address what the growth model for the next thirty years will be. It cannot be defined by what it is not – namely a polluting and sweatshop environment. Although the service sector is important, a return to manufacturing and ensuring access to commodities to generate growth remain fundamental. There may be a “green manufacturing revolution” in prospect but it won’t happen by itself with economic investments, incentives and a hard working workforce. Growing debt cannot be ignored, because it is increasingly difficult to find lenders to lend to the member governments simply to keep spending going without prospect of resumption of robust economic growth.

- The third consequence will be to accelerate the global competition for capital. The “good” debt rating countries will compete with other members of the European community, the United States, China and other major contributors to global economic growth. Capital is getting more costly; and Europe is in direct competition with the United States for many of the same sources of capital. If the European economy stagnates or falls back into recession, there will be flight of capital to the safest alternatives. Investors will seek to preserve capital by parking in the most liquid world markets, where assets bought one week could, if needed, be sold the next week without significant losses. The most liquid markets for parking are the US, and to a lesser extent, the UK and Japan. Already, in the spring of 2010, we can see collapsing confidence in European leadership in the form of accelerating selloff of the Euro with capital flight to the dollar.

- The fourth consequence is that the rising cost of capital and the cost of the social welfare system will put downward pressure on public expenditures. All public expenditures whether defense, non-defense, medical or whatever will be under pressure from the challenge to manage the Euro and its underlying debt structure.

Source: The Financial Times

Source: The Financial Times

The Euro crisis provides a foundation from which several strand of new European development might well emerge.

- First, the French-German bargain that built Europe will be under growing strain as the end to the Common Agricultural Policy (CAP) looms in 2013. Since the birth of the EEC, the CAP was the critical mechanism which provided funding of the Euroean Commission and transfer payments from industrial centers to the peasants and farmers in rural Europe. Germany’s transfer payments to its neighbors were the crucial adhesive which bound together not only the nations but the peoples of what eventually became the European Union and the Eurozone.

Earlier in this decade EU leaders decided the time had come to undertake major structural reforms in the CAP. The Germans especially wanted to end their role as paymasters for farmers and peasants in neighboring countries. When Poland sought to join the EU, the Germans saw the prospect of ever growing and never ending transfer payments to that potentially gigantic agricultural producer. An historic meeting between French President Chirac and German Chancellor Schroeder took place in which the Germans pushed for a phase out of the CAP. Chirac, whose personal political base was rural French farming, refused immediate reform, but the two leaders agreed that major changes could begin in 2013 – after Chirac’s time as President. We are now approaching 2013, and many Germans are looking forward to becoming a “normal” nation, without obligations to send Euros from Germany to its neighbors to support their rural voters. If the CAP were to come to an end, or be drastically curtailed, one consequence would be a major reduction in the flow of cash which now supports the European Commission and its various programs. This political adhesive among EU members would become less effective, and open new domestic political stresses within several of the German neighbors.

- Second, the German dependence upon European trade and economic relationships is growing less as its dependence on Russia and Asia grows. The ties between Berlin and Moscow will grow stronger as the Germans deal with need to have reliable and cost effective energy and commodities to keep their manufacturing sector vibrant. This is especially true as the Chinese build their global commodities base in areas where the Germans would not be able to contest the growing significance of Chinese ties. As for the Franco-German alliance, the French elite have started to question the value to France of close links to an increasingly assertive Germany. The financial crisis of the Euro countries in the spring of 2010 was marked by German bullying of France’s leadership and the public subordination of Paris to Berlin. Impending diminution of German support of rural France adds additional heavy political strain.

Source: The Financial Times

- Third, Northern Europe, notably Norway and Denmark, will have access to the Arctic and its commodities over the years ahead. The opportunity to build economic wealth and ties in the North will increase in importance over loyalty to Brussels and the management of the flow of expenditures between Northern and Southern European which Brussels currently manages.

The need to shape a new economic growth model and the re-structuring of Europe along the lines suggested will also reshape European security and defense. On the one hand, there will be less public sector money available to provide for defense. This would certainly suggest that engagements in lands not seen as directly connected to strategic interests – Afghanistan certainly comes to mind – will be jettisoned.

On the other hand, growing strategic threats from states like Iran, and the need to ensure infrastructure security and to ensure the flow of commodities and goods may well drive European states to reconsider their commitments to security and investments in air and naval assets essential to the global flow of goods and services.

Source: The Financial Times

Source: The Financial Times

Reconfiguration of European interests will happen against the backdrop of an America which will be competing with Europe for capital, and reducing its ability to defend the global commons, to use a current US phrase. A significant drawdown of US power projection capabilities and growing commitment to land forces will challenge European states to consider how best to ensure for own security. On the other side of the Atlantic, current assumptions in Washington that security ties with Europe remain essentially intact will likely be tested as European ability to maintain the role of a player in world security recedes.

———–

***Posted on May 21st, 2010