2016-07-01 By Robbin Laird

At the recently held Trade Media Brief 2016 in Munich, Stephan Miegel, head of Military Aircraft Services for Airbus Defence and Space provided an overview on the company’s approach to services and support to military combat systems.

At the same time, an article appeared in National Defense, which highlighted the evolving Boeing approach.

This provided a natural opportunity to compare the approaches.

After Boeing lost their latest fighter contract bid, this time in Denmark, the new head of Boeing Defense informed us that Boeing was no longer focused on fighters.

“If I told you that I am and want to be a market leader in the fighter business, you all would tell me that I’m an idiot,” said Leanne Caret, executive vice president of Boeing and president and CEO of the BDS unit. “Let’s be real clear: we lost JSF.”

She added: “We need to stop defining Boeing’s future based on a single program or two programs, and we have been doing that with the fighter story. It doesn’t mean it was wrong or right, I just don’t think it represents the great diversity of the Boeing Defense portfolio.”

They also lost the bomber contract, the C-17 is no longer built and this raises the question of what exactly is the core focus going forward.

One answer seems to be logistics and support.

According to the article in National Defense by Sandra Erwin, Boeing is seeking to dominate military aviation logistics.

The company has made no secret that it intends to make a full-court press in military aviation support services and training, and that goal was made clear when it appointed Edward “Ed” P. Dolanski president of global services and support, one of five major units of Boeing Defense, Space & Security…..

We aren’t having discussions inside the company about why we didn’t win the last fighter contract,” Dolanski said. “That’s not in the debate. What is in the discussions now is that the opportunities to grow services are immense,” he added. “We doubled the size of Aviall over a nine-year period.”

Initiatives to capture more services contracts are getting especially strong advocacy from the top leadership, he said. Boeing President and CEO Dennis Muilenburg and Boeing Defense, Space and Security President Leanne Caret both have in recent years been in charge of the services unit.

Boeing is forecasting growth in the defense sector in other segments besides aviation logistics, including space launch, satellites, helicopters, unmanned aircraft and what it calls “commercial derivatives.” These are passenger jets that are customized for military use, as is the case with 737s that are transformed into Navy P-8 maritime surveillance aircraft. The company also is building refueling tankers for the Air Force from 767 airframes.

While support services are far less glamorous than manufacturing fighters, they almost certainly ensure profits over the long run. “If you look at the sale of the platform, 30 percent of the cost is the acquisition of the platform. The logistics tail is 70 percent,” said Dolanski. “It is a very long tail.” Military derivatives of commercial aircraft like the P-8 are “designed to fly a very long time,” he said. “So as a business leader you would naturally put your attention into services. That’s an annuity, fundamentally. Other companies have used it as an annuity. And it’s worked quite well.”

Boeing plans to aggressively compete for support work not just for the aircraft it built but also for platforms made by competitors. The company currently does maintenance and upgrades of several aircraft that were not designed or made by Boeing such as the F-16 Viper, the T-38 trainer, the QF-16 aerial target and the A-10 Thunderbolt. It produces the technical manuals of all C-130 cargo aircraft variants, supports the Air Force Special Operations Command’s C-130 gunships and the B-2 stealth bomber under a contract from Northrop Grumman. Boeing also operates the F-16 mission-training center and oversees F-22 crew training.

Conceivably, Boeing could one day provide maintenance services for the F-35 joint strike fighter, made by Lockheed Martin. That is entirely plausible, Dolanski said. “I don’t see any platforms in my mind that are off limits. We look and see if the customer has a need where we can help. And we want to be a part of that help.”

Does Airbus have a similar approach in mind?

Clearly, they seek to support the programs they build and sell.

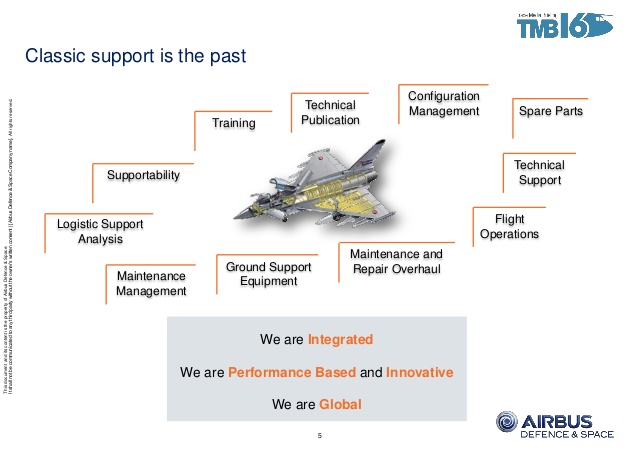

But the approach there is evolving from a classic approach, which is more global, and performance based.

In other words, the focus is upon industry becoming a partner to the customer in delivering performance-based logistics.

The challenge for both Airbus and Boeing will be to ensure that they support the platforms they sell – for they will face competition at this level – and at the same time craft an approach which is platform agnostic and be viewed by users as potentially sound in dealing with platforms they do NOT build or sell.

That is a core challenge.

And this will depend upon the customers as well.

If the core customer is focused upon performance based opportunities and the companies can demonstrate their capabilities associated with their core platforms, but build engineering and support skills which can be applied throughout the combat force, growth is clearly possible.

One challenge which Boeing will face is that the US uses a depot system which limits the maneuver room for US companies to provide for logistic services.

The UK is the most innovative MoD in the world in unleashing performance-based logistics, which has clearly benefited both BAE Systems and Airbus.

The A330 MRTT could be a flagship program for Airbus in this sense as a global user community can be leveraged to shape common approaches and of course the plane flies to areas of conflict. And these areas can provide servicing for multiple fleets.

But there is the limitation upon cross-leveraging commercial to military systems.

In regard to the case of the A330MRTT, the Deputy head of the RAAF had this to say:

Question: You are part of the global sustainment approach of the C-17, do you see something akin to this for the KC-30A fleet?

Air Vice Marshal McDonald: Yes we are a part of the very successful C-17 sustainment system and I would like to see a similar model bought in for the KC-30A.

But what first needs to be worked out is how to tap into the commercial parts pool for the global commercial A330 fleet.

Right now the military certification of the KC-30A does not readily translate into the commercial certification of a A330 so that even though the parts are often the same we cannot tap into the commercial parts pool.

Obviously, this makes little sense.

It’s blindingly obvious, but sometimes you have to be quite innovative to make that blinding obvious come into an executable outcome.

We can have a KC-30A parked on the tarmac next to a group of A330s and know they have the parts we need in their repair and support bays but we cannot access them.

We need to solve this one.

When we visited Jacksonville, we learned of a similar challenge facing the military version of the 737 as well.

We asked about any advantages on deployment to the aircraft being a 737.

“If you can access a trusted buyer it is possible to get commercial pars, but our own supply system only utilizes their process to get secure parts. If we could access the commercial sector when deployed it would save us time waiting for parts and enhance aircraft availability.”

Currently, this is difficult and “when we deploy around the world we currently take our own support equipment, our own tires and our own parts.”

Clearly, working with trusted vendors can shorten the supply chain problem when deployed.

“We had an issue on deployment where a lightening strike damage one of our aircraft.

A team from Boeing came out to survey the damage. We needed to replace a part and did not have that part in our inventory in Navy Supply.

The Navy went out into the commercial sector and bought part and it came in quickly when ordered and it had Made in Australia stamped on it.”

A work in progress as well is to leverage the data generated by operational aircraft to provide for enhanced sustainment support.

Un-correlated data which does not feed back into the supply chain or leveraged for maintenance is not very helpful.

But customers have to allow you to access the flow of operational data and real world performance to build an accurate picture of performance and only by this foundation can you then shape effective performance based logistics.

For example, the A400M is a software rich airplane which is upgraded and maintained based on the flow of operational data. But will the European and global customers allow Airbus to work the data to provide for the kind of performance based logistics which the plane operating as fleets could allow?

This is a work in progress, but the French and British are doing parts sharing currently on the A400M.

An example of what can be achieved was highlighted by Miegel with regard to the A400M operated by the RAF. He underscored that Brize-Norton where the support fleet operates is employing a whole force approach for the RAF and this allows for an innovative A400M support approach as well.

In short, there are significant opportunities in the services and support market.

But this will depend on customer demand and working relationships with industry. 21st century air systems are increasingly software upgradeable and operate as fleets.

Will the customers allow industry the capability to leverage a new approach?